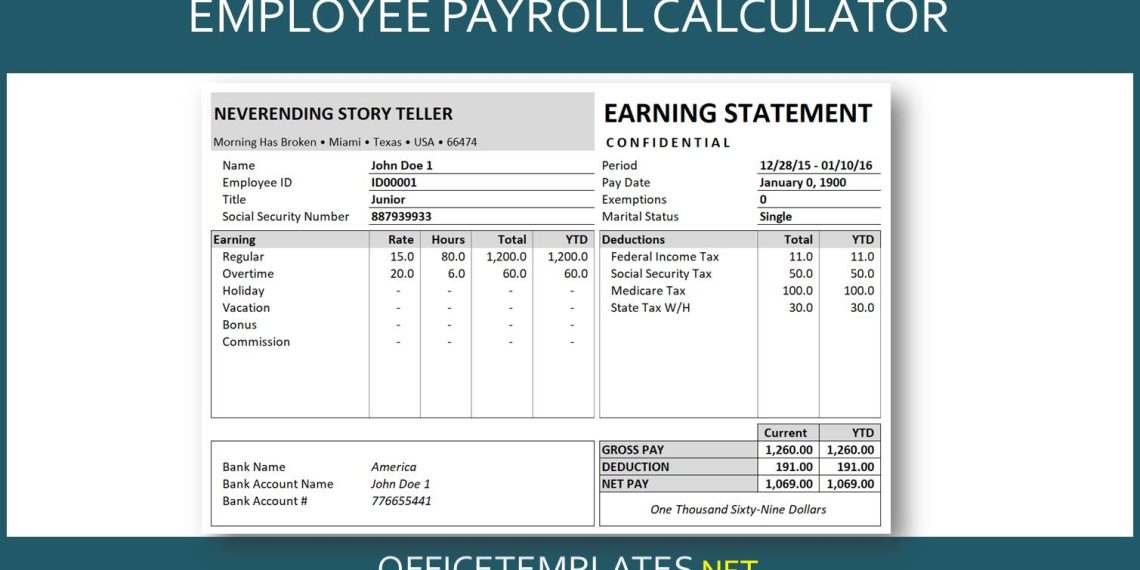

A payroll calculator is a tool that employers use to calculate pay and taxes for employees. It’s also used to keep track of bonuses and other extra payments that employees receive.

A good payroll calculator should have a general salary section and a place to input taxes taken from employee paychecks. It should also include a section for additional withholdings.

Payroll Taxes

Payroll taxes are a confusing term for many people. They can be challenging to understand, and it’s essential that employees and employers both have a clear understanding of payroll taxes and how they affect their paychecks.

Employees are required to have federal income taxes withheld from their paychecks if they earn more than $2000 in a calendar year. The employer calculates and pays this tax based on employee earnings and other factors.

As a business owner, you should avoid paying payroll taxes. First, however, you must understand how to calculate these taxes and how much you owe the government to avoid penalties and audits with the help of the best payroll calculator.

Calculating payroll taxes is intricate and requires knowledge of the various laws and regulations that apply to your company. Hiring a certified payroll specialist or using a payroll software solution can make this process easier for your business.

Payroll Deductions

Payroll deductions are payments an employer makes on behalf of a worker based on the employee’s gross income. They include Social Security, Medicare, and federal income tax payments.

These deductions are processed each pay period based on tax laws and withholding information provided by employees or a court order. They can be automated using a payroll service provider or processed manually.

Generally, the employer withholds taxes are based on the Form W-4 Employee’s Withholding Certificate and the employer’s state and local tax laws. However, the amounts can also vary based on the employee’s choice of benefits or other factors, including job-related expenses.

Employers must withhold federal income taxes and other taxes imposed by state and local governments. These taxes are deducted from the employee’s gross income, and then the employer sends them to the IRS.

In addition to these taxes, employers must match employee Social Security and Medicare contributions.

Payroll Expenses

Expenses associated with payroll include salaries and wages, employee benefits, tax withholdings, and bonuses. Depending on the type of business, these expenses may vary.

Regardless of the size of your company, it is essential to calculate the payroll expenses and taxes owed by your business. These include federal, state, and local income and social security taxes, Medicare, and employment taxes.

You should also include taxes withheld from your employees’ paychecks, such as federal and state unemployment taxes. However, before deducting these amounts from an employee’s gross wages, you must subtract any pre-tax deductions, such as Medicare or 401(k) contributions.

Once you’ve determined what’s owed in taxes, calculate the money you’ll need to pay to remit these amounts to the appropriate authorities. These taxes are generally referred to as “payroll liabilities.”

Your payroll system will automatically track the gross wages that your employees earn each week. It is a crucial step because it lets you quickly verify how much your employees make per hour and whether they have additional pay sources, such as tips or commissions.

Having a payroll system that allows you to track employee information helps your business stay compliant with government regulations and keeps your business safe from potential fines or penalties. It also accurately represents your staff’s productivity and how they impact your overall profit margin.

Payroll Reimbursements

Payroll reimbursements are expenses that an employer pays employees who have submitted work-related expenses. These expenses may include taxes paid to the state or federal government. They also include health insurance premiums and national insurance contributions.

These payments are often disbursed directly to the employee’s bank account. It works well for both the business and the employee. It saves the company money and makes it easier to keep track of payments.

The payroll accounting process is complex, and it’s essential to have accurate records of every transaction. It includes the types of entries that you make, how they’re recorded, and how you set up your payroll accounting system.

Payroll accounting is a great way to manage your finances, so you must use it correctly. It can be tricky to get started, but it’s a vital part of your overall financial management.

A lot of businesses use payroll software to streamline the process. These systems allow you to input hours worked, deduct taxes and other deductions, and then pay employees at the end of the payroll period.

It can be time-consuming, and you’ll need to check in regularly with your accountant to ensure that all the necessary payments are being made and that you are following the right procedures.

A good payroll calculator will help you determine the amount needed to be disbursed and how much each payment should be allocated to each tax category. It will also show you whether you need to make any adjustments before the end of your accounting period.