Pivot points are well-known for being practical tools for technical analysis that aid traders in locating crucial support and resistance levels in the financial markets. These levels are possible turning points for price movement and offer helpful information for trading decisions. The usage of pivot points in trading strategies and how to maximize their profit potential will both be covered in this article.

Understanding Pivot Points

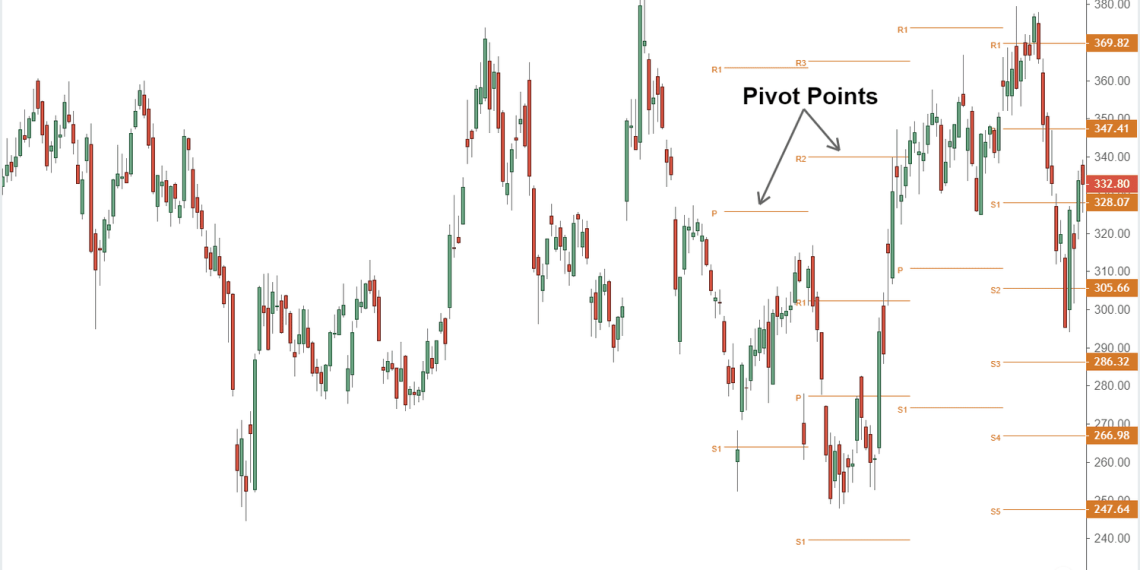

The previous day’s high, low, and closing prices are used to determine pivot points. They serve as benchmarks for assessing future pricing changes. The procedure entails calculating the pivot point by first averaging the previous day’s high, low, and closing values. The pivot point is also used to generate two support levels (S1 and S2) and two resistance levels (R1 and R2).

Using Pivot Points for Support and Resistance Levels

Pivot points serve as dynamic support and resistance levels, offering insights into potential market reversals and breakout opportunities. Traders can use the following strategies to incorporate pivot points into their trading approach:

Pivot Point Bounce Strategy:

When the price approaches a pivot point, it may bounce off the level, indicating a potential reversal. Traders can look for confirmation signals, such as candlestick patterns or indicators, to enter trades in the direction of the bounce.

Pivot Point Breakout Strategy:

If the price breaks through a pivot point level, it often signifies a strong momentum move. Traders can initiate positions toward the breakout, aiming for more significant price movements. Confirmation from other technical indicators can enhance the validity of the breakout.

Identifying Market Trends with Pivot Points

Pivot points can also determine the overall market trend and help traders align their trades with the prevailing direction. The following methods can be employed to identify market trends:

Pivot Point Trend Confirmation:

By analyzing the current price and pivot point relationship, traders can assess whether the market is bullish or bearish. If the price remains above the pivot point, it suggests a bullish trend, while prices below it indicate a bearish trend.

Multiple Time Frame Analysis:

Combining pivot points from different time frames can provide a clearer perspective on market trends. Traders can use daily pivot points to determine the overall trend and switch to lower time frames for precise entry and exit points.

Incorporating Pivot Points with Other Indicators

To increase the accuracy of trading decisions, pivot points can be combined with other technical indicators. Integrating pivot points with indicators such as moving averages, Fibonacci retracements, or oscillators can provide more robust signals. It’s important to understand that pivot points should complement other analysis tools rather than be used in isolation.

Managing Risk and Setting Targets

A crucial aspect of trading is effective risk management. Pivot points can assist in setting stop-loss levels and profit targets. Traders can place stop-loss orders slightly beyond the pivot point or the nearest support or resistance level. Profit targets can be selected at subsequent support or resistance levels derived from pivot points.

Finding the Right Broker

Choosing a reliable and reputable broker is essential for successful trading. We have compiled a list of the top-rated brokers to assist you in your search. These brokers offer competitive trading conditions, reliable execution, and a user-friendly platform. Conduct thorough research and consider factors such as regulation, fees, customer support, and trading instruments before making a final decision.

Backtesting and Fine-Tuning Pivot Point Strategies

Once you have developed a trading strategy using pivot points, it’s crucial to backtest and fine-tune it before implementing it in live trading. Backtesting involves applying the method to historical market data to assess its performance and profitability. By analyzing the results, you can identify strengths and weaknesses, make necessary adjustments, and optimize the strategy for better results.

When backtesting a pivot point strategy, consider the following steps:

Select a time Frame

Determine the time frame that aligns with your trading style and goals. For intraday trading, you may choose shorter time frames, like 5 or 15 minutes, while swing traders may prefer daily or weekly charts.

Define Entry and Exit Criteria

Clearly define the rules for entering and exiting trades based on pivot points. For example, specify the conditions for entering a trade when the price bounces off a support level or breaks through a resistance level. Determine the criteria for setting stop-loss and take-profit levels as well.

Gather Historical Data

Acquire historical price data for the selected time frame and market you intend to trade. This data can be obtained from various sources, including trading platforms, data providers, or specialized websites.

Apply the Strategy

Implement your pivot point strategy on the historical data, following the defined rules for entering and exiting trades. Keep track of the transactions executed, including the entry, exit, and resulting profit or loss.

Analyze the Results

Evaluate the performance of your strategy by reviewing the trading outcomes. Calculate metrics such as the win rate, average gain/loss, and drawdown to assess the profitability and risk profile of the strategy. Identify patterns or trends in the results to gain insights into potential adjustments.

Adjust and Optimize

Based on the analysis, modify the strategy to improve its performance. This could involve tweaking entry and exit criteria, adjusting stop-loss and

take-profit levels, or incorporating additional technical indicators to refine trade signals.

Conclusion

Pivot points are powerful tools for technical analysis, providing traders with valuable support and resistance levels, reconduct, and breakout opportunities. You can make more informed trading decisions by incorporating pivot points into your trading strategy and combining them with other indicators.

Remember to backtest and fine-tune your processes to optimize performance and manage risk effectively. Continuous learning, adaptation, and staying informed about market developments are critical factors in becoming a successful trader.