A household Insurance strategy normally covers four sorts of occurrences on the protected property: inside harm, outside harm, misfortune or harm of individual resources/effects, and injury that happens while on the property. At the point when a case is made on any of these episodes, the mortgage holder will be expected to pay a deductible, which is the personal expenses for the protected.

The sansure.co.za is an Authorized Financial Services Provider and member of Financial Intermediaries Association of Southern America. They are expert in short term insurance industry. They are confident that their experience and knowledge will be of great benefit to you.

Do I Need Household Insurance?

Before we get into the low down of all your household Insurance questions, we should get going by saying we unequivocally suggest that you have household Insurance, essentially for all the worth it offers — regardless of whether household Insurance isn’t commanded by regulation the same way that vehicle insurance is. Remember that if you’re hoping to buy a home, or on the other hand if you’re a property holder that has applied for a home loan, your bank will probably expect you to buy household Insurance first at any rate.

Having household Insurance can shield you from being required to pay a huge singular amount to fix the harm to your property and individual things if something happens to or in your home. In this way, although household Insurance isn’t a necessity, it certainly assumes a vital part in safeguarding what might be your most prominent resource.

What Does Household Insurance Cover?

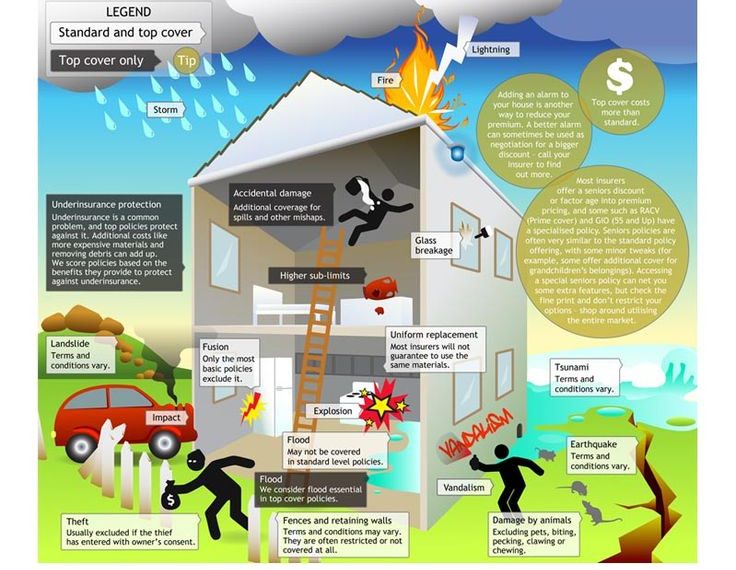

Household Insurance covers expenses that happen when something surprising or coincidental happens to your home and additionally your assets. That implies that you’ll get monetary insurance against misfortunes because of burglary, fire, wind harm, and significantly more. Would it be advisable for anything to happen to your home, your standard strategy can incorporate inclusion for the design of your home, inclusion for your effects, and inclusion for extra everyday costs (on the off chance that you can’t reside in that frame of mind while it’s being fixed because of a covered misfortune).

Household Insurance likewise covers something other than your home. It can likewise act the hero if somebody harms themselves on your property, or the other hand assuming you harm another person’s property or coincidentally harm somebody. This is where your responsibility security will kick in which is likewise regularly remembered as a standard strategy.

Where Can I Buy Household Insurance?

Comparison Websites: these are effective methods for tracking down insurance that meets your requirements. Yet, recall that the least expensive arrangement isn’t awesome for you, so don’t just pick the first you see. Adhere to our brilliant guidelines for utilizing correlation locales to purchase insurance and see our aide on Finding the best arrangement with cost examination sites.

Direct From Insurers: not all backup plans are covered by examination locales – Aviva, Zurich, and Direct Line are among the huge names that don’t show up – and their items must be purchased simply.

Insurance Brokers: they can assist you with getting the most appropriate household Insurance for your conditions, especially if you have muddled needs (for example you’re a landowner safeguarding a few properties). See our aide on When to utilize a insurance dealer.

How Much Household Insurance Cost?

Indeed, similarly to how contract payments will contrast from one property holder to another, so will the expense of household Insurance. What you pay for your household Insurance expenses will rely upon factors like how much inclusion you need or even the area of your home, among numerous different elements.