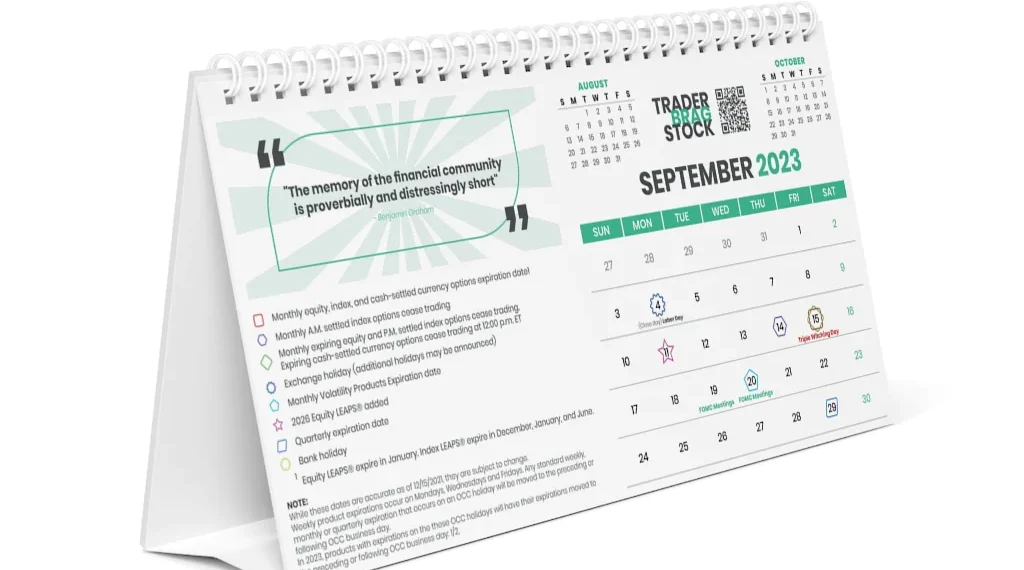

The Federal Open Market Committee (FOMC) is the policy-making arm of the Federal Reserve System. The FOMC is responsible for setting the target range for the federal funds rate. The federal funds rate is the rate at which depository institutions lend reserve balances to other depository institutions overnight. The FOMC Calendar is released eight times a year. The FOMC Calendar is released eight times a year. The calendar is released about two weeks before the FOMC meeting. The calendar includes the date, time, and location of the meeting. It also includes the agenda for the meeting. The agenda is released on the day of the meeting.

Trading Based On FOMC Calender

The FOMC Calendar is released to the public after the meeting. The minutes of the meeting are released three weeks after the meeting. The minutes provide a detailed record of the meeting. They include a discussion of the economic conditions that led to the meeting and the policy decisions that were made. The FOMC Calendar is an important tool for traders. The calendar can help traders predict when the federal funds rate will be increased or decreased. Traders can use the calendar to make decisions about when to buy or sell assets.

The FOMC calendar is a great tool for new traders to get acquainted with the Federal Open Market Committee and its inner workings. The calendar lays out the committee’s meeting schedule for the year, as well as the topics that will be discussed at each meeting. In addition, the calendar provides a brief overview of the FOMC’s monetary policy decisions. The FOMC calendar can be found on the Federal Reserve’s website. The fomc calendar is typically released in January, and is updated as needed throughout the year.

The FOMC calendar is a great tool for new traders to get acquainted with the Federal Open Market Committee and its inner workings. The calendar lays out the committee’s meeting schedule for the year, as well as the topics that will be discussed at each meeting. In addition, the calendar provides a brief overview of the FOMC’s monetary policy decisions. The FOMC calendar can be found on the Federal Reserve’s website. The calendar is typically released in January, and is updated as needed throughout the year. The FOMC calendar is a great tool for new traders to get acquainted with the Federal Open Market Committee and its inner workings. The calendar lays out the committee’s meeting schedule for the year, as well as the topics that will be discussed at each meeting. In addition, the calendar provides a brief overview of the FOMC’s monetary policy decisions.

FOMC Calender For New Traders

The FOMC calendar can be found on the Federal Reserve’s website. The calendar is typically released in January, and is updated as needed throughout the year. The Federal Open Market Committee (FOMC) is the primary monetary policymaking body of the United States Federal Reserve System. The FOMC consists of the seven members of the Board of Governors of the Federal Reserve System and five of the twelve Federal Reserve Bank presidents, who serve on a rotating basis. The Committee meets eight times a year, approximately once every six weeks. The economic projections and dot plot are important for traders because they give an idea of where the Fed is headed in the future. If the projections show that the economy is doing well and inflation is under control, then the Fed is likely to raise rates. If the projections show that the economy is slowing down or inflation is rising, then the Fed is likely to lower rates.

The FOMC calendar is released every two weeks and lists the dates of the next eight FOMC meetings. The calendar is released eight times per year, typically on the Wednesday following an FOMC meeting. The release of the FOMC calendar is significant because it provides investors with advance notice of when the FOMC will be meeting to discuss monetary policy. This allows investors to position themselves ahead of time in anticipation of potential policy changes.

At each meeting, the FOMC reviews economic and financial conditions and decides whether to change the target range for the federal funds rate. The federal funds rate is the interest rate at which depository institutions lend reserve balances to other depository institutions overnight. The target range for the federal funds rate is set by the FOMC at each meeting and is announced after the meeting.

Conclusion

The FOMC calendar is important for investors because it can give them a heads up on potential policy changes that could impact the markets. For example, if the FOMC is meeting to discuss a possible interest rate hike, investors may begin to position themselves ahead of time in order to benefit from the potential increase in rates.