If you are considering opening a checking account without a deposit, you should be aware of the various available types. There are also many practical aspects to remember when deciding on a checking account. For example, do you need a minimum balance in your account? Some banks offer a free checking account with no monthly maintenance fees or minimum balance requirements. Some also offer free checking with direct deposit and electronic statements.

Direct Deposits

Opening a checking account without a deposit is an option that allows you to get the money you need without having to make a deposit. Many banks offer such accounts, but you must meet certain requirements to receive them. Most of these have a minimum deposit requirement or require that you have a certain average daily balance. You should also be aware of the bank’s bonus requirements, which can vary from bank to bank.

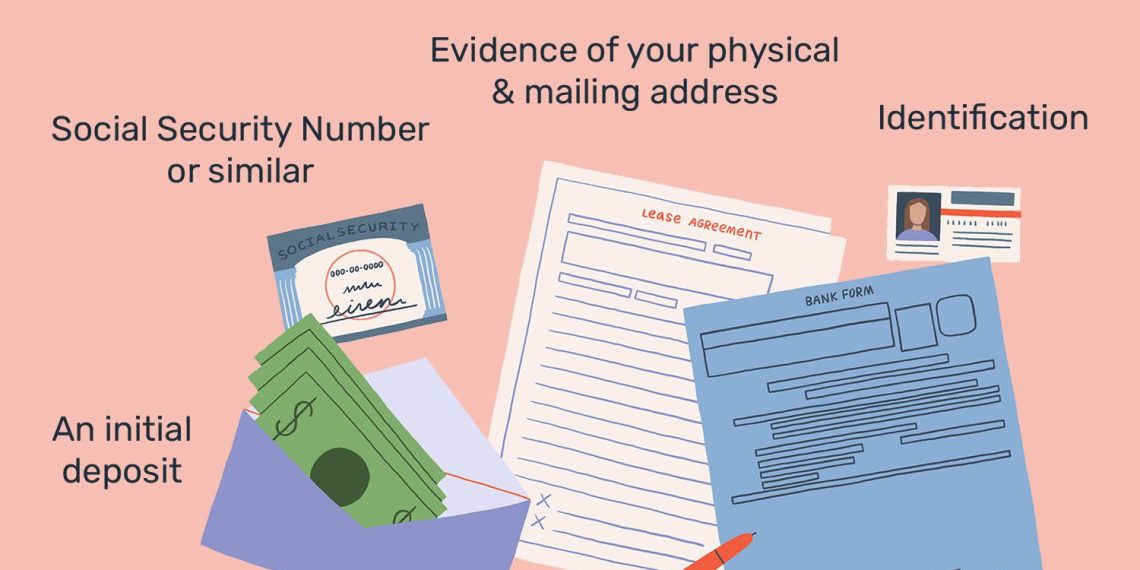

The first step is to contact the bank you want to open the account at. The bank may require a few documents, depending on whether you are a U.S. citizen or a foreign national. You may have to wait 30 days for the account to be active. You can fund the account with direct deposit from your employer during this time. You’ll have to complete a form with your account number and voided check to set up direct deposit.

You can also open a checking account without a deposit at online banks and credit unions. These institutions don’t have brick-and-mortar locations and therefore don’t have as many overhead costs as traditional banks. This allows them to pass the savings on to their customers. Besides, many of these institutions also offer free checking accounts.

Overdraft Protection

Overdraft protection is a convenient way to prevent overdraft fees. You can set up an alert to notify you when your account falls below a certain level, and some banks even provide multiple alerts to let you know when your balance is getting too low. Although this service may not be necessary for all individuals, it can save you from embarrassment and help you complete transactions quickly. Overdraft protection can also help you avoid costly returned check fees.

Some banks offer overdraft protection for a small monthly fee. This service works by linking another account to your checking account. If you go overdrawn, the bank will transfer the money into your checking account. Then, you will pay interest on the overdraft until you pay it off. However, before opening an overdraft protection line of credit, you should check your credit score.

Overdraft protection is a great way to avoid rejecting debit card and ATM transactions when your account is overdrawn. Most banks offer this protection for a small fee and often include a grace period. It is important to understand that banks are not required to offer this protection, and they may retain the right to refuse overdraft transactions. It is important to read your deposit account agreement and the terms of any overdraft protection programs offered.

Minimum Balance Requirement

A no-deposit checking account may be the perfect solution if you are on a tight budget. This type of account usually has low fees and no minimum balance requirement. Plus, it can help you organize your finances. However, you should be aware of the risks associated with these types of accounts.

When opening a checking account, the most important thing to consider is whether you have the money to deposit. Many banks require a certain minimum balance before opening an account for you. These minimum balance requirements are only sometimes a good idea for a checking account, so you should always read the fine print before signing up. Some banks will charge you a fee if you do not meet the requirements.

You may also be required to keep a certain amount in your account daily. This is to avoid incurring maintenance fees and interest on your balance. Most financial institutions list these requirements on their website. If you do not want to pay these fees, look for an account with no minimum balance requirement. In addition, consider opening an account with direct deposit so that you can avoid incurring fees.

Online Banking Tools

More banks are offering no-deposit checking accounts, and you can take advantage of this benefit. These digital institutions do not have the overhead costs associated with brick-and-mortar branches, so they can offer you the convenience of not having to deposit to open a checking account. Many online banks are also available on mobile devices so that you can manage your account.

Some online banks even offer a free $20 bonus when you open a new account. All you have to do is provide the necessary information and connect to another account, whether it is your traditional bank account or another online bank. After connecting, you can review transactions, save money on postage, and avoid fees.

The best banks offer a variety of free checking accounts. These accounts usually have low minimum balances and no monthly service fees. Other benefits include 24/7 access to your money and using more than one ATM to get cash. You can also get unlimited transactions for free with some banks.